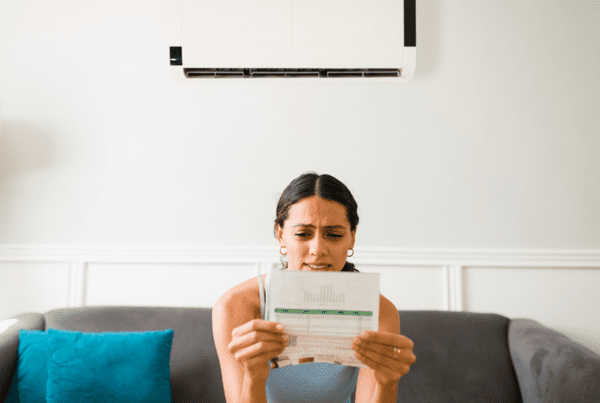

As energy costs rise and environmental concerns grow, many homeowners are looking for ways to improve their home’s energy efficiency. One effective solution is installing a heat pump, which can significantly reduce energy consumption and costs. Thanks to recent legislation, there are substantial tax credits available to help offset the cost of these installations. Here’s how you can take advantage of these incentives.

What is a Heat Pump?

A heat pump is an all-in-one heating and cooling system that transfers heat between your home and the outside air. Unlike traditional HVAC systems that generate heat by burning fuel, heat pumps move existing heat, making them much more energy-efficient. This efficiency can lead to significant savings on your energy bills.

Understanding the Heat Pump Tax Credit

The Inflation Reduction Act (IRA) of 2022 introduced several tax credits aimed at promoting energy efficiency, including those for heat pumps. Homeowners can claim a tax credit of up to 30% of the cost of a qualifying heat pump, with a maximum credit of $2,000 per year12. This credit is available for installations made from January 1, 2023, through December 31, 20321.

How to Qualify

To qualify for the heat pump tax credit, the following criteria must be met:

Eligible Property: The heat pump must be installed in your primary residence located in the United States1.

Efficiency Standards: The heat pump must meet specific energy efficiency standards set by the Department of Energy2.

Qualified Manufacturer: Starting in 2025, the heat pump must be produced by a qualified manufacturer, and you must report the product’s PIN on your tax return1.

Steps to Claim the Credit

Purchase and Install: Buy and install a qualifying heat pump in your primary residence.

Keep Records: Save all receipts and documentation related to the purchase and installation.

File Form 5695: When filing your taxes, complete IRS Form 5695 to claim the Residential Energy Efficient Property Credit1.

Consult a Tax Professional: Consider consulting with a tax professional to ensure you meet all requirements and maximize your credit.

Additional Incentives

In addition to the federal tax credit, many states offer additional incentives for installing energy-efficient systems. These can include rebates, state tax credits, and other financial incentives2. Check with your state energy office or local utility company to see what programs are available in your area.

Conclusion

Installing a heat pump is a smart investment that can lead to significant energy savings and environmental benefits. By taking advantage of the available tax credits and incentives, you can reduce the upfront cost and enjoy the long-term benefits of a more efficient home. Make sure to stay informed about the latest requirements and consult with professionals to maximize your savings.

1: IRS – Energy Efficient Home Improvement Credit 2: Forbes – Heat Pump Tax Credit 2024

If you have any specific questions or need further assistance, feel free to ask!